The 10 Most Expensive Paintings Ever Sold

Salvator Mundi by Leonardo Da Vinci is the most expensive painting ever to be sold. It went under the hammer for $450 million at a 2017 Christie’s auction.

Besides that, there are other masterpieces that fetched mind-blowing amounts at auction events and private sales.

In this article, we’ll cover the 10 most expensive paintings ever sold and a few other expensive artworks. Then, we’ll dive into some interesting facts about expensive art.

We’ll also introduce you to Masterworks: a platform that helps you invest in shares of world-class artwork easily.

The 10 Most Expensive Paintings Ever Sold

Here are the 10 highest-grossing paintings in the world:

- Salvator Mundi – Leonardo Da Vinci

- Interchange – Willem de Kooning

- The Card Players – Paul Cézanne

- Nafea Faa Ipoipo (When Will You Marry?) – Paul Gauguin

- Number 17A – Jackson Pollock

- The Standard Bearer – Rembrandt

- Shot Sage Blue Marilyn – Andy Warhol

- No. 6 (Violet, Green and Red) – Mark Rothko

- Wasserschlangen II – Gustav Klimt

- Pendant portraits of Maerten Soolmans and Oopjen Coppit – Rembrandt

1. Salvator Mundi – Leonardo Da Vinci

- Price and Year of Sale: $450 million, 2017

- Seller: Dmitry Rybolovlev

- Buyer: Badr bin Abdullah al-Saud

On November 15, 2017, at a Christie’s auction in New York, Salvator Mundi became the most expensive artwork ever sold.

And for a good reason — the Salvator Mundi has a long history.

The painting was reportedly commissioned by the French monarch King Louis XII around 1500, the same period when the Mona Lisa was created.

Art historians hadn’t attributed the painting to the Italian master Da Vinci before the 21st century. It was reportedly looted by the Nazis during World War II and changed hands several times, before being noticed at a New Orleans auction house in 2005 by Robert Simon and Alexander Parrish.

The two bought the painting for just $1,500.

It took six years of research before historians confirmed its authenticity. They finally attributed it to the old master Leonardo da Vinci before putting it up for auction.

According to Bloomberg, the painting is now held by Mohammed bin Salman, crown prince of Saudi Arabia.

Here’s a fun fact:

The Salvator Mundi is also known as “The Lost Leonardo” since it’s the first artwork by Da Vinci discovered since the Benois Madonna in 1909.

2. Interchange – Willem de Kooning

- Price and Year of Sale: $300 million, 2015

- Seller: David Geffen Foundation

- Buyer: Kenneth C Griffin

This painting by Willem de Kooning is the most expensive piece of modern art ever sold. Its sale amount was the highest price paid for a painting at that time.

The large pink mass in the center of the painting represents a reclining woman.

This abstract art piece was the first painting marking a shift in style for De Kooning, as he went from painting abstracts of women to abstract landscapes.

In 2015, David Geffen famously sold this painting along with Jackson Pollock’s Number 17A for $500 million to American billionaire hedge fund manager Kenneth C Griffin.

Note: The individual sale prices of Interchange and Number 17A are estimates.

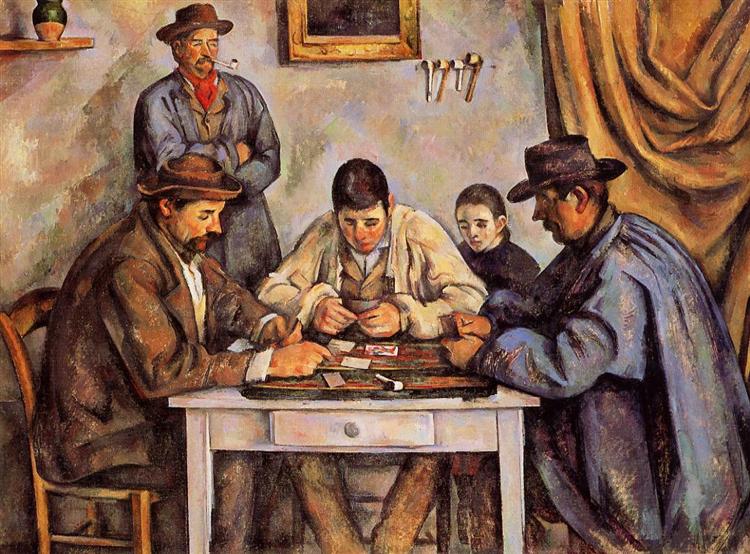

3. The Card Players – Paul Cézanne

- Price and Year of Sale: Around $250 million, 2011

- Seller: George Embiricos

- Buyer: State of Qatar

The Card Players by Paul Cézanne was the most expensive painting in the world from 2011 to 2015.

This version is one oil painting from a series of five Post-Impressionist works, all painted by Paul Cézanne. Each painting has slight variations — the number of people at the table, the venue of the game and even the size of the canvases are all different.

While the Royal Family of Qatar bought this version of the painting, another version is housed at the Musée d’Orsay in Paris, France.

4. Nafea Faa Ipoipo (When Will You Marry?) – Paul Gauguin

- Price and Year of Sale: $210 million, 2014

- Seller: Rudolf Staechelin heirs

- Buyer: State of Qatar

Paul Gauguin first visited Tahiti in 1891 and fell in love with the island and its people.

One year later, he painted Nafea Faa Ipoipo, a Post-Impressionist, expensive artwork depicting two Tahitian women in a colorful and vibrant landscape.

But how did Gauguin end up on this faraway island?

Paul Gauguin was once a close companion of Vincent van Gogh. The two lived together for some time and painted different depictions of the same subjects.

However, when an argument between the two escalated, Paul Gauguin left for Paris and then for Tahiti.

Fun fact: The first time Nafea Faa Ipoipo was sold after Gauguin’s death, it fetched only 7 francs.

5. Number 17A – Jackson Pollock

- Price and Year of Sale: Around $200 million, 2015

- Seller: David Geffen Foundation

- Buyer: Kenneth C Griffin

Number 17A is the most expensive drip painting in the world.

This abstract expressionism artwork was created in 1948, one year after Jackson Pollock pioneered his drip painting method.

In 1949, Life magazine featured this 20th-century painting, effectively launching Pollock into celebrity status.

Note: The individual sale prices of Interchange and Number 17A are estimates.

6. The Standard Bearer – Rembrandt

- Price and Year of Sale: $198 million, 2022

- Seller: Rothschild family

- Buyer: Rijksmuseum

The Dutch painter Rembrandt was known for his self-portraits, including The Standard Bearer.

It’s a three-quarter-size work of art that Rembrandt created to showcase his ability to paint military portraits since they were lucrative themes for commissions at the time.

The Louvre Museum originally wanted to purchase the expensive artwork from the private collection of the Rothschild family, but couldn’t find adequate funds.

So the Rijksmuseum, the Dutch government and the Rembrandt Association stepped in and bought the painting. It’s currently housed at the Rijksmuseum in Amsterdam.

7. Shot Sage Blue Marilyn – Andy Warhol

- Price and Year of Sale: $195 million, 2022

- Seller: Thomas and Doris Ammann

- Buyer: Larry Gagosian

In 1964, American artist Andy Warhol created five silkscreen paintings of Marilyn Monroe and named them Marylins.

But how did the name “Shot Marylins” originate?

After Andy Warhol created the paintings, he invited American performance artist Dorothy Podber to his gallery. Once she saw the Marilyns stacked against each other, she asked Warhol whether she could “shoot them.”

Warhol thought she wanted to photograph the paintings and agreed, but Podber took out a revolver and fired a single shot that pierced four paintings. After this incident – the paintings were known as Shot Marylins.

All four versions of this Marilyn Monroe painting are highly sought-after by collectors.

The Shot Sage Blue Marilyn set a record as one of the most expensive 20th-century artworks when it sold for $195 million in May 2022 at Christie’s, New York.

8. No. 6 (Violet, Green and Red) – Mark Rothko

- Price and Year of Sale: $186 million, 2014

- Seller: Cherise Moueix

- Buyer: Dmitry Rybolovlev

20th-century art icon Mark Rothko was known for his Color Field artworks — vibrant, rectangular paintings portraying various emotions through color.

This expensive artwork stays true to the artist’s style.

No. 6 is a red canvas with a violet square on top and a green strip below it. All the color edges are softened and shaded.

This abstract art painting was created in 1951 and sold for $186 million in 2014 from the private collection of Cherise Moueix.

After its last sale, No. 6 by Rothko has been the focus of a legal battle known as the Bouvier Affair. There were complaints by Russian billionaire Rybolovlev and other art buyers that art dealer Yves Bouvier defrauded them while selling high-value pieces.

9. Wasserschlangen II – Gustav Klimt

- Price and Year of Sale: $183.8 million, 2013

- Seller: Yves Bouvier

- Buyer: Dmitry Rybolovlev

Wasserschlangen II, also known as Water Serpents II, is a vibrant and expensive artwork by Gustav Klimt.

He finished it in 1907, soon after his Water Serpents I oil painting.

Both paintings expressed the sensual aura of the female form and same-sex relationships. This oil painting was looted by the Nazis in World War II and gifted to a Nazi filmmaker.

In 2013, the filmmaker’s widow put it up for sale. She split the proceeds with the heirs of the painting’s rightful owner.

10. Pendant portraits of Maerten Soolmans and Oopjen Coppit – Rembrandt

- Price and Year of Sale: $180 million, 2016

- Seller: Éric de Rothschild

- Buyer: Rijksmuseum and Louvre

Rembrandt painted the portraits of newlyweds Maerten Soolmans and Oopjen Coppit in 1634.

The painter was only 28 years old at the time – and the couple were two of his early patrons.

These two portraits are the only full-length paintings by Rembrandt. Their last public display before their sale to the museums was in 1956, while they were still in a private collection.

The Louvre in France and the Rijksmuseum in the Netherlands bought the two paintings together.

However, an intergovernmental treaty requires the paintings to always be displayed as a set. This means that the paintings are housed at each museum for eight years before moving to the other.

Now, let’s look at a few other expensive paintings by other world-famous artists.

10 Other Expensive Paintings by Master Artists

Here are some more expensive paintings by renowned artists.

| Artwork | Artist, Year | Medium & Size | Selling Price | Year of Sale |

| Les Femmes d’Alger(Version O) | Pablo Picasso (1955) | Oil on canvas, 114 cm × 146.4 cm | $179.4 million | 2015 |

| Nu couché | Amedeo Modigliani (1917) | Oil on canvas,60 cm × 92 cm | $170.4 million | 2015 |

| Portrait of Adele Bloch Bauer II | Gustav Klimt (1912) | Oil on canvas,190 cm × 120 cm | $150 million | 2016 |

| Three Studies of Lucian Freud | Francis Bacon (1969) | Oil on canvas triptych, 198 cm × 147.5 cm for each canvas | $142.4 million | 2013 |

| The Scream | Edvard Munch (1893) | Oil, tempera, pastel and crayon on cardboard,91 cm × 73.5 cm | $119.9 million | 2012 |

| Meules | Claude Monet (1890) | Oil on canvas,72.7 × 92.6 cm | $110.7 million | 2019 |

| Untitled | Jean Michel Basquiat(1982) | Acrylic, spray paint and oil stick on canvas,183.2 cm × 173 cm | $110.5 million | 2017 |

| Flag | Jasper Johns (1954-55) | Encaustic, oil and collage on fabric mounted on plywood,107.3 × 153.8 cm | $110.0 million | 2010 |

| Portrait of an Artist (Pool with Two Figures) | David Hockney (1972) | Acrylic on canvas,210 × 300 cm | $90.3 million | 2018 |

| Portrait of Dr Gachet | Vincent Van Gogh(1890) | Oil on canvas, 67 cm × 56 cm | $82.5 million | 1990 |

Interesting Facts About Expensive Artworks

Here are some questions you may have about expensive paintings:

- How Much Is The Mona Lisa Worth?

- Why are Some Artworks So Expensive?

- Do Artists Benefit From Highly-Valued Artwork?

- Who are the Main Buyers of Expensive Art?

1. How Much Is the Mona Lisa Worth?

The Mona Lisa was insured for $100 million in 1962 – the equivalent of $860 million in 2022!

It’s regarded by many as the most valuable painting in the art world, but you’ll probably never see it at auction.

French heritage law prohibits the buying or selling of the Mona Lisa. So by law, it belongs to the French public and cannot be moved from the Louvre.

2. Why Are Some Artworks So Expensive?

Blue-chip art by artists like Pablo Picasso, Amedeo Modigliani, and Roy Lichtenstein sells for hundreds of millions of dollars at auction.

A UBS and Art Basel report shows that only 0.2% of artists have artwork valued at over $10 million. However, about 32% — or $20 billion of art sales comes from that 0.2%.

Why?

The best artists have very limited portfolios. Even those who are alive today can only produce a limited number of original pieces. When the demand for art by top artists is disproportionately high, their prices go skyrocketing.

Besides, each piece of art is unique. Most artists rarely create multiple copies of the same work of art — and even then, they won’t be exactly the same. This can drive up art prices even further.

3. Do Artists Benefit From Highly-Valued Artwork?

Artists only benefit when their artwork is sold on the primary market — that is, when their paintings are purchased from a gallery or directly from them.

Artists don’t receive any money when artwork sells at an auction or private sale.

However, high prices at auction events can indirectly benefit artists since they can raise their prices for other works in the primary market.

4. Who are the Main Buyers of Expensive Art?

The market for expensive art has expanded, and there are more art collectors now than ever. The liberalization of Asian and Eastern European countries has increased international demand for art.

Art investors have also started purchasing artwork from auction houses like Christie’s and Sotheby’s in London to diversify their portfolios.

This is because fine art indices have shown fair returns over the years.

According to the Citi Art Advisory Report 2021 using data from Masterworks :

- The contemporary art market averaged annual returns of 7.5% between 1958 and 2018.

- The art market returned about 5.3% on average during the same time.

If you’re an aspiring investor, you might be looking for a way to add contemporary art or other types of fine art to your portfolio.

While you can shell out hundreds of millions at auction houses and private sales, you can easily invest in shares of these masterpieces through Masterworks.

Own Shares of Masterpiece Paintings Through Masterworks

Masterworks is the first platform for investors looking to invest in shares of famous paintings.

Here’s how Masterworks operates:

- Masterworks researches artists whose artworks have potential to increase in value.

- Masterworks purchases less than 5% of the artwork we’re offered.

- Masterworks securitizes and offers the artwork to investors.

- Investors can trade shares on the secondary market or wait until the painting is sold to receive returns if the piece sells at a profit.

Why Invest With Masterworks?

Here’s what makes Masterworks stand out:

- Access to Masterworks’ Price Database: When you sign up, you get access to proprietary data that Masterworks uses to identify artists with potential to appreciate in value.

- Invest in Artwork With High Potential: Masterworks’ acquisition team strives to identify and invest in artwork with the highest likelihood of potential returns.

- Easy Pricing Structure: Masterworks has an easy-to-understand fee structure. Masterworks charges a 1.5% annual management fee payable in equity. The platform also receives 20% of profits upon the selling of artwork.

Ready to Invest in World-Renowned Masterpieces?

Paintings created by the world’s most popular contemporary artists can also be lucrative investments that represent the eternal legacy of master artists.

Ready to invest in multimillion dollar paintings by Mark Rothko, Pablo Picasso and Andy Warhol?

Then check out what Masterworks has in store for you.

The content is not intended to provide legal, tax, or investment advice. Past performance is not indicative of future performance. Investing involves risk. See important disclosures at masterworks.com/cd

*[Please note: All investing activities involve risks and art is no exception. Risks associated with investing through the Masterworks platform include the following: Your ability to trade or sell your shares is uncertain. Artwork may go down in value and may be sold at a loss. Artwork is an illiquid investment. Costs and fees will reduce returns. Investing in art is subject to numerous risks, including physical damage, market risks, economic risks and fraud. Masterworks has potential conflicts of interest and its interests may not always be aligned with your interests.

Liquidation timing is uncertain. Expenses and fees are listed in our Offering Circulars. Note: Fees are 1.5% per annum (in equity), 20% profit share, and certain expenses are allocated to the investment vehicle. Investors should review the offering circular for a particular offering to learn more about fees and expenses associated with investing in offerings sponsored by Masterworks. Masterworks will receive an upfront payment, or “Expense Allocation” which is intended to be a fixed non-recurring expense allocation for (i) financing commitments, (ii) Masterworks’ sourcing the Artwork of a series, (iii) all research, data analysis, condition reports, appraisal, due diligence, travel, currency conversion and legal services to acquire the Artwork of a series and (iv) the use of the Masterworks Platform and Masterworks intellectual property. No other expenses associated with the organization of the Company, any series offering or the purchase and securitization of the Artwork will be paid, directly or indirectly, by the Company, any series or investors in any series offering. For more information, see “IMPORTANT DISCLOSURES” at Masterworks.com/cd.

This post was sponsored by Masterworks