Gifts That Keep on Giving: What to Buy for Your Loved Ones (That May Make Them Money Too)

The holidays draw closer by the day, and you’re wondering what to get the special someone in your life, whether partner, parent, or beyond. So read on, because these eight categories of collectible gifts could become keys to your future, both emotionally and financially, becoming both timeless gifts and valuable assets. From fine art to rare coins, each holds the potential to elevate your financial future, so dive into the realm of nostalgia and rarity as we explore how seemingly ordinary possessions may just be the extraordinary ticket to securing your retirement dreams. Break out that wrapping paper, because these presents will probably pay for themselves.

1. Postage stamps

Stamp collecting, known as philately, is a fascinating pursuit that transforms small, adhesive-backed pieces of paper into windows into history and culture. Enthusiasts meticulously curate albums, navigating a global tapestry of design and significance. From commemorating historical events to showcasing artistic mastery, each stamp is a miniature work of art. Collectors immerse themselves in a world of rarities, errors, and thematic series, fostering both historical understanding and aesthetic appreciation. As a timeless hobby, stamp collecting weaves together the threads of geography, history, and art, inviting individuals to embark on a captivating journey through the pages of their own philatelic albums.

2. Collectible cars

Collecting collectible cars is a pursuit fueled by a blend of passion and nostalgia. Enthusiasts delve into a world where every vehicle tells a story, reflecting an era of design, engineering, and cultural significance. From sleek classics to iconic muscle cars, the thrill lies in preserving automotive history. Beyond the joy of ownership, collectors revel in the quest for rare models, meticulously maintaining and showcasing their prized possessions. It’s a community where camaraderie and a shared love for craftsmanship converge, turning each garage into a personalized museum that celebrates the timeless allure of the automobile.

3. Fine art

While many of us may have an old canvas we’ve held onto for decades out of nostalgia, the ceiling for fine art collecting is high, and you never know what you can find in your collection. It’s true, fine art collecting is often thought of as the kind of thing limited to the billionaire class, as according to the 2022 Art Basel and UBS Art Market Report, 61% of high-net-worth collectors report allocating over 10% of their portfolios to art. Fine art is a popular asset for these investors likely for its favorable investment characteristics. Fine art differs from traditional assets and other alternatives for its ability to act as a store of wealth to hedge against inflation and currency devaluation. So maybe it’s not such a bad idea to take a second look at that piece hanging over the mantle.

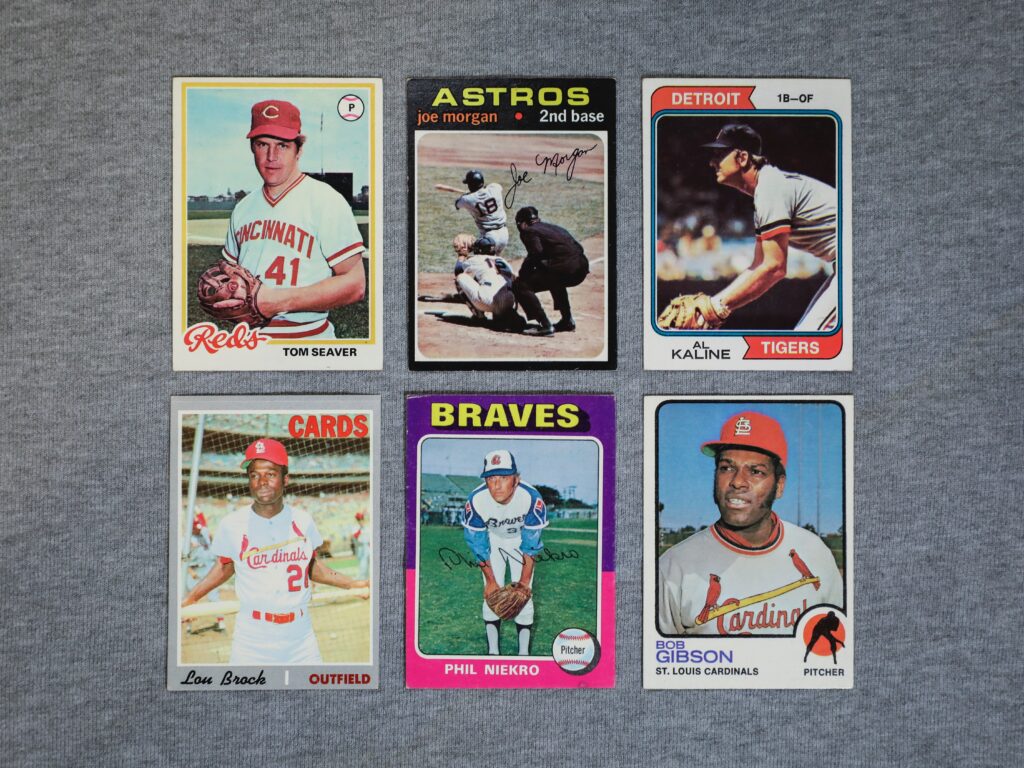

4. Baseball cards

Photo: Mick Haupt

Collecting vintage baseball cards has become a compelling investment strategy for enthusiasts. Beyond the nostalgia they evoke, these cards often appreciate in value over time, turning a hobby into a potentially lucrative venture. Rarity, condition, and historical significance are key factors determining a card’s worth. Savvy collectors research player statistics, card grading systems, and market trends to make informed choices. As the demand for vintage cards continues to grow, this unique blend of passion and investment acumen attracts those seeking both financial gains and a tangible connection to the rich history of America’s favorite pastime.

5. Vintage furniture

Investing in vintage furniture has emerged as a sophisticated avenue for financial growth and aesthetic appreciation. Discerning collectors recognize that well-preserved, iconic pieces from bygone eras often appreciate in value over time. Eames chairs, mid-century modern gems, and antique heirlooms are sought after for their craftsmanship and historical significance. Tracking design trends, understanding restoration techniques, and identifying reputable sources are crucial for successful investment. As the market for vintage furniture continues to expand, enthusiasts find themselves not only curating a unique living space but also making astute financial decisions by investing in timeless pieces that stand the test of time.

6. Rare coins

Rare coin collecting is a captivating pursuit that blends history, art, and investment. Numismatists meticulously seek coins with unique attributes, such as minting errors, historical significance, or limited editions. Key factors include rarity, condition, and provenance, with collectors often focusing on coins from specific eras, countries, or themes. The hunt for elusive treasures drives a community of enthusiasts who appreciate the intricate craftsmanship and cultural narratives embodied in each coin. As a tangible link to the past, rare coins offer collectors both a glimpse into history and the potential for a valuable and diverse numismatic portfolio.

7. Comic books

Photo: Erik Mclean

Vintage comic book collecting is a passionate pursuit, where enthusiasts delve into the golden ages of storytelling and superhero iconography. Collectors seek rare and iconic issues, focusing on first appearances, key story arcs, and pristine conditions. The allure lies in owning a piece of pop culture history, with sought-after comics often featuring beloved characters like Spider-Man or Batman. Additionally, limited print runs, variant covers, and significant events within a series contribute to a comic’s desirability. Beyond financial value, collectors treasure the nostalgia and cultural impact encapsulated in the vibrant pages of vintage comic books.

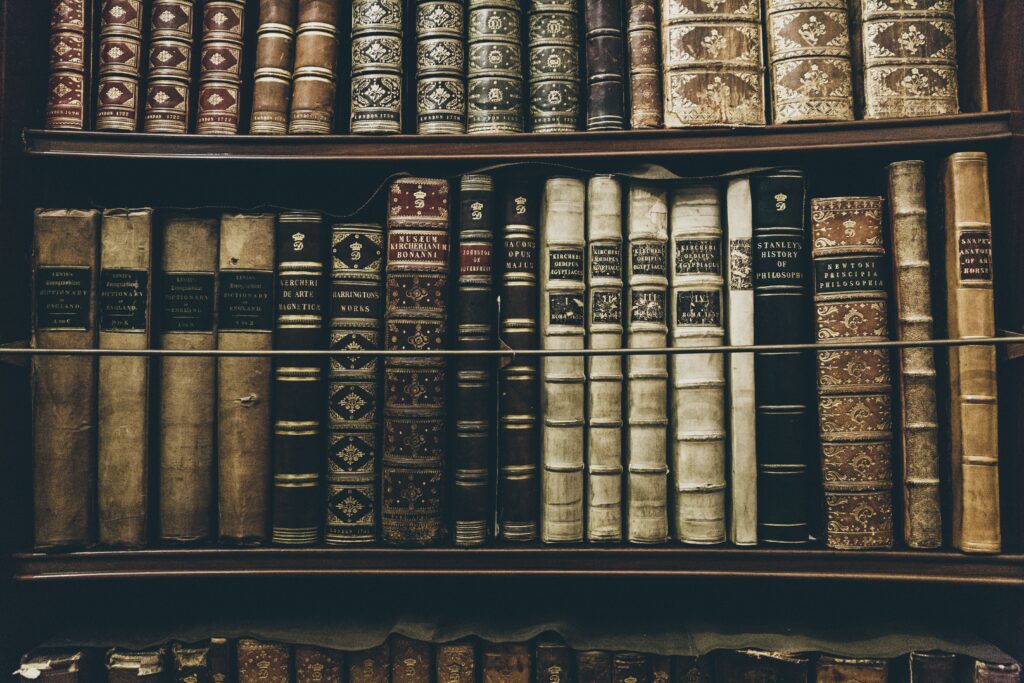

8. Vintage books

Photo: Thomas Kelly

Vintage book collecting is a literary adventure, where bibliophiles explore the past through rare and collectible editions. Enthusiasts seek first editions, signed copies, and books with unique provenance. Condition, scarcity, and the author’s significance are pivotal factors, guiding collectors in their quest for literary treasures. From classic literature to niche genres, the appeal lies not only in the stories within the pages but also in the tangible connection to history and culture. The pursuit of vintage books is a scholarly and aesthetic endeavor, turning personal libraries into curated collections that breathe life into the written word across eras.

Please note: All investing activities involve risks and art is no exception. Risks associated with investing through the Masterworks platform include the following: Your ability to trade or sell your shares is uncertain. Artwork may go down in value and may be sold at a loss. Artwork is an illiquid investment. Costs and fees will reduce returns. Investing in art is subject to numerous risks, including physical damage, market risks, economic risks and fraud. Masterworks has potential conflicts of interest and its interests may not always be aligned with your interests.

Liquidation timing is uncertain. Expenses and fees are listed in our Offering Circulars. Note: Fees are 1.5% per annum (in equity), 20% profit share, and certain expenses are allocated to the investment vehicle. Investors should review the offering circular for a particular offering to learn more about fees and expenses associated with investing in offerings sponsored by Masterworks. Masterworks will receive an upfront payment, or “Expense Allocation” which is intended to be a fixed non-recurring expense allocation for (i) financing commitments, (ii) Masterworks’ sourcing the Artwork of a series, (iii) all research, data analysis, condition reports, appraisal, due diligence, travel, currency conversion and legal services to acquire the Artwork of a series and (iv) the use of the Masterworks Platform and Masterworks intellectual property. No other expenses associated with the organization of the Company, any series offering or the purchase and securitization of the Artwork will be paid, directly or indirectly, by the Company, any series or investors in any series offering. For more information, see “IMPORTANT DISCLOSURES” at Masterworks.com/cd

This post was sponsored by Masterworks.com/cd