The Business Cycle: The 4 Phases & Investment Strategies

What Is the Business Cycle?

The business cycle, also known as the economic cycle or trade cycle, describes the natural fluctuations of aggregate economic activity experienced over time. These fluctuations can include changes in employment, output and prices.

How Does the Business Cycle Work?

The business cycle is a term used by economists to describe the fluctuation of economic activity over time. It refers to the cyclical patterns of growth and contraction in the economy, which is made up of all economic activities within a given country or region.

During the expansion phase of the business cycle, businesses are growing and increasing their production, leading to a higher demand for labor. This causes employment levels to rise and gives people more money to spend, which further fuels economic growth. As businesses see an increase in profits, they can focus on expansion and growth opportunities.

However, this upward trend will eventually reach a peak and will start to slow down, signaling the start of the next phase of the business cycle.

When economic activity slows down and production decreases, businesses don’t need as many employees, leading to job losses and less money in consumers’ pockets. This, in turn, leads to reduced spending by businesses, resulting in a decline in overall economic activity. This phase of the business cycle is known as “economic contraction.”

Measuring and Dating the Business Cycle

The National Bureau of Economic Research (NBER) officially declares business cycle stages for the US economy. It’s important to keep in mind that within a phase of the business cycle, there may be mini-fluctuations that can make it seem as if the economy is transitioning to another phase.

NBER’s Business Cycle Dating Committee determines recession start and end dates after the fact. They use quarterly real GDP growth rates, employment, real personal income, real income, industrial production, national income and retail sales — all key coincident economic indicators.

- Read More: Investing During a Recession

The Four Phases of the Business Cycle

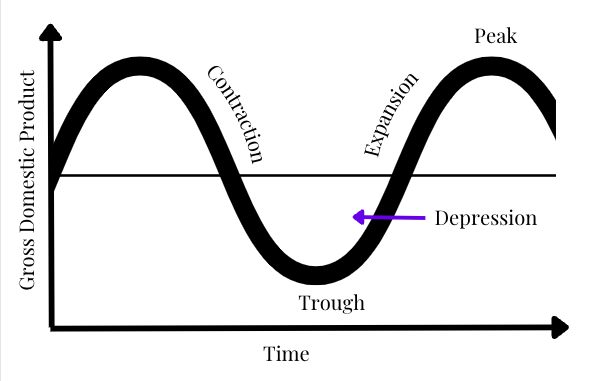

The business cycle is the pattern of economic expansion and contraction that occurs over time, following the same four phases.

It’s worth noting that business cycles vary in amplitude and duration. Some are short and mild, while others are long and severe. When the phases are severe, that has been described as a boom and bust cycle.

In recent decades, business cycle recessions have become less frequent. Economists now focus more on growth cycles, which consist of alternating periods of above-trend and below-trend growth.

However, it can be difficult to attempt forecasting economic phases because it is dated using coincident economic indicators as opposed to leading indicators.

Expansion

This is the period of growth in the economy. During this stage, businesses are growing, employment is increasing, income and spending are rising and stock prices are climbing.

The expansion phase nears its end when the economy begins to grow too quickly, also known as “overheating.” During this time, the unemployment rate tends to be well below the natural rate — potentially even reaching full employment — and inflation tends to heat up.

Stock market investors during this period can be in a state of “irrational exuberance,” where they become overly enthusiastic about prices and believe they will continue to rise. This causes stock prices to rise to unsustainable and overvalued levels.

Peak

The expansion phase eventually comes to an end, and the economy reaches its highest point, called the peak. At this turning point, economic indicators such as gross domestic product (GDP) and employment have reached their highest levels and inflation pressures may begin to build.

Contraction

After the peak, the economy enters a period of contraction, also known as a recession. During a contraction, economic activity slows, businesses and individuals slow spending, stock prices downturn and unemployment rises.

Trough

Eventually, the contraction phase comes to an end, and the economy reaches its lowest point, called the trough. At this point GDP and employment have reached their lowest levels, and the economy is ready to begin expanding again.

What Influences the Business Cycle

It’s important to note that these factors are often interrelated and can influence each other in complex ways. The business cycle is not a perfect curve and not all countries, sectors and industries experience the same amplitude of the cycle.

Monetary Policy

The actions of a country’s central bank — such as the Federal Reserve in the United States — can have a big impact on the economy. When the central bank raises interest rates, it can slow economic growth and lead to a recession. When it lowers interest rates, it can stimulate growth and lead to expansion.

Fiscal Policy

Government spending and taxation policies can also influence the business cycle. When the government increases spending or reduces taxes, it can boost economic growth. On the other hand, when it reduces spending or increases taxes, it can slow growth.

International Trade

A country’s level of trade with other nations can affect the business cycle. When a country exports more than it imports, it can stimulate economic growth. When it imports more than it exports, it can lead to a trade deficit and slow growth.

Consumer Sentiment

Consumer confidence is a key driver of economic activity. When consumers have confidence in the state of the economy and current policymakers, they are more likely to spend money, which can fuel economic growth. When consumers feel uncertain, they are less likely to spend, which can slow growth.

- Read More: High Inflation’s Impact on Consumer Spending

Supply and Demand

According to the Congressional Research Service, the key influence is aggregate supply and aggregate demand. In other words, total consumer spending.

External Events

Natural disasters, geopolitical conflicts, technological advances and epidemics/pandemics can also have a significant impact on the economy and lead to fluctuations on the business cycle.

Past Examples of the Business Cycle

The average length of recessions in the US since World War II has been around 11 months. The Great Recession caused by the 2008 financial crisis was the longest in recent decades, reaching 18 months.

The Great Depression was a severe economic downturn that lasted from 1929 to the late 1930s. It was triggered by the stock market crash of 1929 and was characterized by high levels of unemployment, low industrial production and deflation. The depression was particularly severe in the United States and Europe, but it also affected many other countries around the world.

Governments and central banks responded to the crisis by implementing policies such as increased government spending, monetary expansion and trade protectionism. These policies helped to bring the depression to an end, but it was not until the onset of World War II that many economies fully recovered.

World War II had a profound impact on the world economy, as governments had to devote large amounts of resources to the war effort. This led to widespread government intervention in the economy and full employment.

The war also led to significant changes in international trade and production, as many countries shifted to war production and away from consumer goods. The mobilization for the war led to the end of the Great Depression and started a long period of prosperity known as the Golden Age of Capitalism.

The 2008 financial crisis was a global economic downturn that was triggered by a collapse in the housing market in the United States.

The crisis was caused by a combination of factors, including lax lending standards, over-leveraged financial institutions, and the sale of risky mortgage-backed securities. This led to a severe recession in the United States and many other countries around the world.

Governments and central banks responded to the crisis with a number of measures, including monetary expansion, fiscal stimulus and bailouts of financial institutions.

Investment Strategies for Stages of the Business Cycle

Investment strategies can vary depending on the stage of the business cycle, as different types of assets perform better at different times in the economic cycle.

It’s important to note that these are general suggestions, and having a well-diversified portfolio with a mix of different types of assets is important to reduce risk.

Timing the market precisely and predicting the future trajectory of the economy can be challenging. Therefore, it’s crucial to maintain a long-term perspective when it comes to investing.

Investing During Economic Expansions

This is the stage of the business cycle when the economy is growing and GDP is increasing. Economic indicators such as employment, consumer spending and industrial production are generally positive.

During this stage, investors might consider investing in equities as well as growth-oriented assets such as real estate and small-cap stocks. These assets tend to perform well during times of economic expansion, as companies and property values tend to increase in value.

Investors can also consider investing in emerging markets at this stage, as these economies tend to have a high correlation with global economic growth.

- Read More: Has High Inflation Impacted the Art Market?

Investing During Economic Peaks

This is the stage of the business cycle when the economy has reached its maximum level of growth and is beginning to slow down. Interest rates tend to be high and inflationary pressures may start to build.

At this stage, investors might consider reducing their exposure to equities, as stocks tend to be overvalued and may be at risk of a pullback.

Instead, investors might look to invest in more defensive assets and focus more on portfolio diversification. Diversifying your investments with non-correlated assets such as collectibles and Contemporary Art can be useful to store value for the long term. These assets tend to be less risky and can provide a steady income, which can be valuable during a downturn.

Investing During Recessions

Investing during a recession can be challenging, as economic downturns can lead to a decline in stock prices and a higher risk of default on bonds. However, with the right approach, it’s possible to identify investment opportunities even in a difficult economic environment.

Defensive assets, safe haven assets and alternative investments tend to outperform the general market during economic downturns as they best store value as prices climb as more investors turn to them.

Contemporary art, for example, has come out of the past three economic downturns with an average return of over 7% while the S&P 500 returned an average of -17%.

Investing During Economic Troughs

At this stage, investors may consider investing in undervalued equities, as they have the potential to offer good returns as the economy improves.

Additionally, value-oriented assets such as dividend-paying stocks and real estate may also be attractive investments during this stage.

It’s an opportunity for investors to take a contrarian approach and capitalize on values overlooked by others during the recession.

The Bottom Line

The business cycle, also known as the economic cycle, refers to the fluctuations of economic activity that an economy experiences over time.

It includes four stages — expansion, peak, recession and trough — and each stage has unique characteristics that can affect various aspects of the economy, such as employment, production and prices.

Macroeconomic policies and regulations implemented by governments play a role in mitigating the impact of downturns and promoting sustainable growth.

Understanding the business cycle is essential for making informed investment decisions, as different types of assets perform better at different times in the economic cycle.

While the business cycle is a normal part of any market economy, it’s important to keep in mind that identifying the stage of the business cycle is not an exact science, and having a well-diversified portfolio with a long-term perspective is crucial in weathering any economic conditions.

Diversify Your Portfolio With Masterworks

Masterworks is an art investment platform that lets you invest in shares of multi-million dollar works of art by Picasso, Bansky, Kaws, and more.

Contemporary Art not only has consistent positive returns during periods of recession but also maintains value and actually appreciates during periods of economic growth. Over the long term, Fine Art has had a low correlation with all broad asset classes, helping keep investment returns consistent regardless of where we are in the economic cycle.

The information in this article is presented for educational purposes only. Information should not be construed as investment advice or form the basis of an investment decision.