Trump’s Famous Portraits–What They’re Really Worth Might Shock You

Former President Donald Trump is renowned for his business acumen and his eye for luxury. Beyond his real estate empire, Trump has also amassed a remarkable collection of one specific asset, a collection that reflects his distinctive taste and penchant for opulence.

Because Trump has long been building an impressive collection of fine art, valued in the millions, which offers a unique window into Trump’s aesthetic sensibilities and has become a significant aspect of his legacy, not only through his acquisitions but also through his influence on the market. His name attached to a piece can significantly impact its perceived value, often leading to increased demand and, consequently, higher prices. This phenomenon, known as the “Trump Effect,” has been noted by art experts and investors alike.

Moreover, Trump’s penchant for acquiring pieces with historical significance has added depth to his collection. Of course, beyond just collecting, Trump is a businessman first. So, what does a billionaire like him know about investing in art that the average person does not?

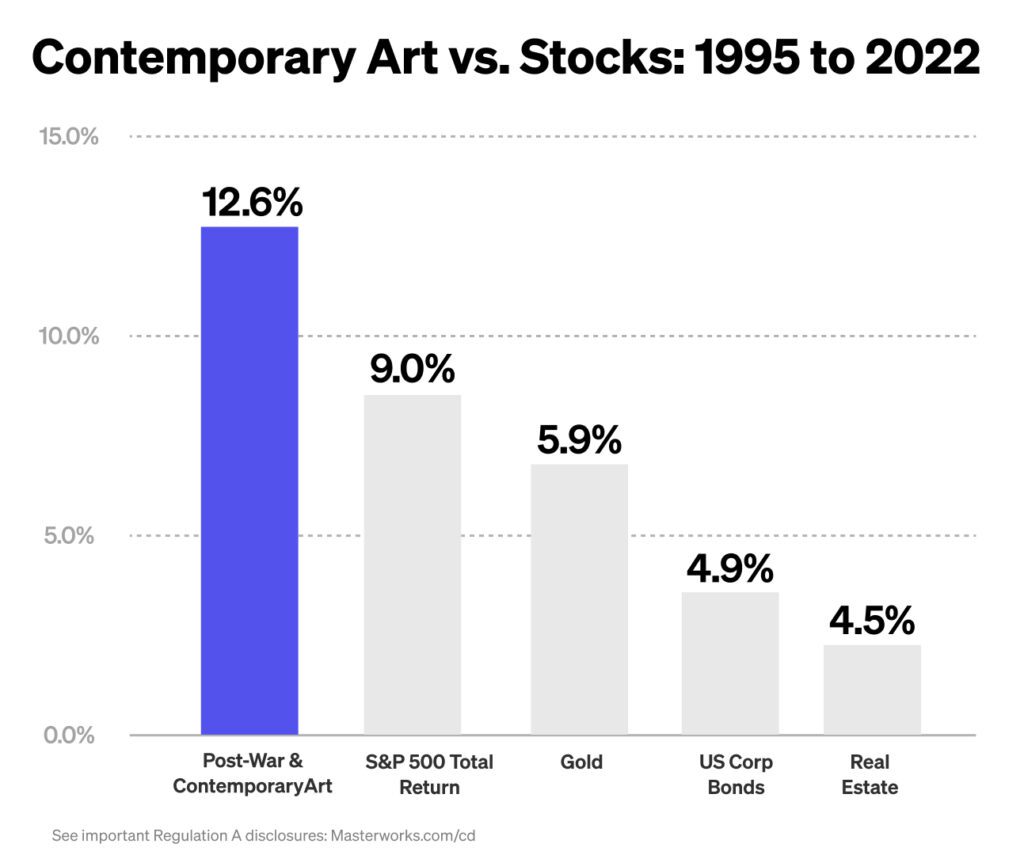

He knows it has served as a store hold of value over time, allowing affluent investors to consistently grow their wealth at a high-rate of return. And its all-weather nature comes with a history of outperformance, low volatility, and ultra-low correlations to other asset classes.

This asset has withstood crisis after crisis… outperforming time and time again… and delivering significant market-beating performance over the long run. And it’s not only been protective on the downside, it has also participated – often outperforming – on the upside.

Walking through some examples when it comes to contemporary art…

From 2008 to 2022 (a period containing six corrections, three bear markets, and two bull markets), adding a 5% contemporary art allocation to a domestic 60/40 portfolio (60% stocks/40% bonds), improved performance 98% of the time on a rolling 5-year basis and 100% of the time on a rolling 10-year basis.

Contemporary art is no stranger to weathering all types of market events. Over the last 27 years, it has overcome events like:

- Dot-com bubble

- 9/11 attacks

- Recessions

- Natural disasters

- Flash crashes

- Global Financial Crisis

- Longest bull market ever

- Greek debt crisis

- Brexit vote

- COVID-19 pandemic

Donald Trump’s art collection is a curated ensemble of pieces that span various genres, from contemporary works to classical masterpieces. It is a testament to his eclectic tastes, featuring works by artists such as Andy Warhol, Norman Rockwell, and even a Renoir piece that adorns Trump’s private jet. With a penchant for large-scale, vibrant pieces, Trump’s collection mirrors his larger-than-life persona and demonstrates a deep appreciation for the power of visual expression.

But how does one collect and diversify their investments into fine art like Trump, without his millions of dollars and behind-the-scenes access?

Well, that problem has been solved.

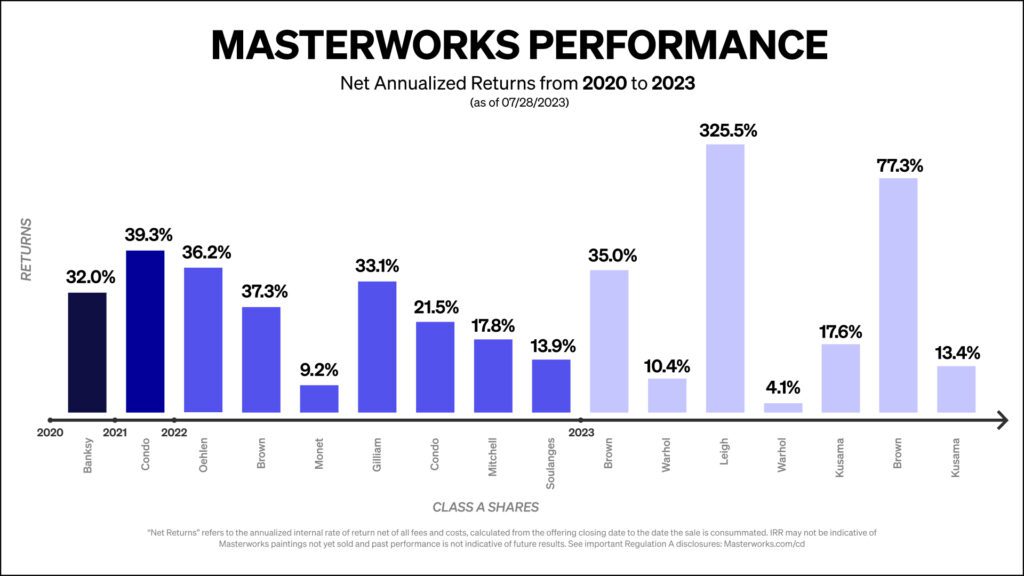

With Masterworks’ platform, anyone can now invest in shares of $1-30 million masterpieces from artists, such as Banksy, Basquiat, and Warhol, for a fraction of the typical cost.

The company has over 200 employees that focus on art daily, including experts from the art industry, and large investment shops (Bank of America, Goldman Sachs, Morgan Stanley, etc.).

Its team has collected transactional records on the art market dating back to the 1960s. Data including over 5 million auction records and 50 million data points, on over 60,000 artists.

And in just a short span of time, it has become one of the largest buyers in the art market.

So far, Masterworks has 16 “exits” (sales). All of which have produced positive returns, with investors sharing millions in profits (net of fees)*.

Since their first sale in 2020, 15 of those 16 exits – or 94% – have outpaced the SPDR S&P 500 ETF (Wall Street’s crown jewel) over their holding periods.

- Read More: Has High Inflation Impacted the Art Market?

Masterworks recently announced they surpassed 800,000 members with almost $900 million in assets under management. In fact, they are growing so quickly, that the demand has created a waitlist, according to the company.

The content is not intended to provide legal, tax, or investment advice. Past performance is not indicative of future performance. Investing involves risk. See important disclosures at masterworks.com/cd

*[Please note: All investing activities involve risks and art is no exception. Risks associated with investing through the Masterworks platform include the following: Your ability to trade or sell your shares is uncertain. Artwork may go down in value and may be sold at a loss. Artwork is an illiquid investment. Costs and fees will reduce returns. Investing in art is subject to numerous risks, including physical damage, market risks, economic risks and fraud. Masterworks has potential conflicts of interest and its interests may not always be aligned with your interests.

Liquidation timing is uncertain. Expenses and fees are listed in our Offering Circulars. Note: Fees are 1.5% per annum (in equity), 20% profit share, and certain expenses are allocated to the investment vehicle. Investors should review the offering circular for a particular offering to learn more about fees and expenses associated with investing in offerings sponsored by Masterworks. Masterworks will receive an upfront payment, or “Expense Allocation” which is intended to be a fixed non-recurring expense allocation for (i) financing commitments, (ii) Masterworks’ sourcing the Artwork of a series, (iii) all research, data analysis, condition reports, appraisal, due diligence, travel, currency conversion and legal services to acquire the Artwork of a series and (iv) the use of the Masterworks Platform and Masterworks intellectual property. No other expenses associated with the organization of the Company, any series offering or the purchase and securitization of the Artwork will be paid, directly or indirectly, by the Company, any series or investors in any series offering. For more information, see “IMPORTANT DISCLOSURES” at Masterworks.com/cd

This post was sponsored by Masterworks.com/cd