What is Inverse Correlation? Definition & Examples

What is Inverse Correlation?

Inverse correlation, also known as negative correlation, refers to a relationship between two variables in which one variable increases as the other decreases.

Understanding inverse correlation is important for investors because it can help them identify opportunities to diversify their portfolios and hedge against risk.

In this article, we’ll delve into the concept of inverse correlation in investments, including how to identify and use it to make informed investment decisions.

Explaining Types of Correlation in Investments

Correlation in investments refers to the extent to which two variables are related.

Positive Correlation vs. Inverse Correlation

- A positive correlation means that the variables move in the same direction. For example, if one variable decreases, the other variable will also see lower values.

- A negative correlation, or inverse correlation, means that the variables move in opposite directions. For example, if the stock market goes up, the value of a bond may go down.

The strength of the correlation between two variables is measured using a correlation coefficient, which ranges from -1 to 1. A coefficient of -1 indicates a perfect negative correlation, while a coefficient of 0 means there is no correlation between the variables. A positive correlation has a coefficient between 0 and 1, where a coefficient of 1 indicates a perfect positive correlation.

Calculating Inverse Correlation

To calculate the inverse correlation, or negative correlation, between two variables, there are two ways to approach it.

You can use the Pearson correlation coefficient formula or you can find the covariance of each variable. This is a statistical measure of the strength and direction of the linear relationship between two variables.

It’s also possible to calculate the correlation between one dependent variable and a series of other independent variables, such as an overall market.

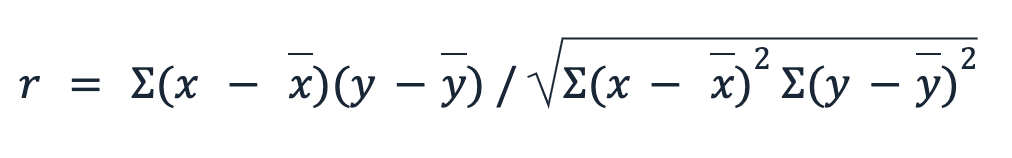

Here is the formula for the Pearson correlation coefficient:

In this formula, x and y are the two variables being measured, x̄ is the mean of the x values, and ȳ is the mean of the y values. The symbol ∑ represents the sum of the values being measured.

To calculate the inverse correlation between two variables, you will need a set of paired data points for both variables. For each data point, subtract the mean of the x values and the mean of the y values from the x and y values, respectively. Then, multiply the differences together and sum them up. This is a form of regression analysis.

Next, calculate the sum of the squares of the differences for the x values and the y values. Take the square root of the product of these two sums. Finally, divide the sum of the products from the first step by the square root from the second step to get the Pearson correlation coefficient.

If the coefficient is negative, this indicates an inverse correlation between the two variables. The closer the coefficient is to -1, the stronger the inverse correlation. A coefficient of 0 indicates no correlation between the variables.

Graphing Inverse Correlation

Two data sets can be plotted on a scatter plot to visualize the relationship between two variables. Plot one set of data on the x-axis and the other on the y-axis, then plot the paired data points on the graph by connecting the x-value and y-value for each data point.

- If the data points form a straight line that slopes downward, this indicates an inverse correlation. The steeper the slope of the line, the stronger the inverse correlation.

- If the line slopes upward, this indicates a positive correlation.

- If the data points show no line or a flat line, this indicates no correlation between the variables.

What Can Inverse Correlation Tell You?

One way to use inverse correlation in investments is to identify assets that have an inverse relationship with each other and consider including them in your portfolio.

For example, if you own stocks that tend to perform well when the stock market is doing poorly, you can use inverse correlation to try to hedge against potential losses in your stock portfolio.

Investing in non-correlated assets and negatively correlated assets is a foundational step to portfolio construction in order to spread out risk and mitigate the impact of sector or market fluctuations. Fine art is one alternative asset that has no correlation with traditional stocks and bonds. In fact, the highest positive correlation art has with any asset class is real estate (0.21).

It’s important to be cautious when relying on inverse correlation, as it is not always a reliable predictor of future performance. It’s a good idea to diversify your portfolio and consider other factors in addition to inverse correlation when making investment decisions.

Limitations of Inverse Correlation

There are several things to keep in mind when using correlation to understand investment products. First, a negative correlation, or any correlation, doesn’t necessarily indicate causation.

Even if two variables have a perfect negative correlation, this by itself doesn’t imply a cause-and-effect relationship.

Additionally, correlation can change over time in both strength and direction. This means that an inverse correlation that holds true in one period may display a positive correlation in the future.

Because of this, using the results of correlation analysis to predict future data sets is unreliable.

Examples of Inverse Correlation in Action

Many alternative assets are considered non-correlated assets because their performance is not correlated with returns in traditional markets. Different assets tend to have different correlations.

The most basic example of a negative relationship in different assets is the historic long-term correlation between stocks and bonds.

Stocks tend to outperform bonds during periods of economic growth. Then, during periods of economic stagnation where the Federal Reserve reduces interest rates to stimulate the economy, bonds tend to outperform equities.

Another example in the investment world is the inverse relationship between gold and the U.S. dollar. Historically, the dollar price of gold has increased as the U.S. dollar depreciates against major foreign currencies, and vice versa.

One alternative investment that has a strong negative correlation with traditional bond and stock prices is Contemporary Art. Over the long term, Fine Art has had a low correlation with all broad asset classes including stocks, bonds and emerging markets.

According to Citi Private Bank 2022 research, Post-War & Contemporary Art has a -0.04 correlation with developed market equities and a -0.18 correlation with high-yield bonds. When comparing to additional assets, Contemporary Art shows little to no correlation to investment-grade bonds (0.15), hedge funds (0.15), private equity (0.10), real estate (0.15) and commodities (0.18).

Broad-based exposure to the art market or to a category within the market thus may help mitigate overall portfolio risks while also pursuing positive returns.

Inverse Correlation and Portfolio Diversification

Inverse correlation may be important for portfolio diversification because it allows investors to include assets in their portfolio that have an opposite relationship to other assets they own. That can help investors mitigate risk by reducing the overall volatility of their portfolio.

For example, if an investor has a portfolio that consists mainly of stocks, they may be at risk of significant losses if the stock market experiences a downturn. By including assets in their portfolio that have a strong negative correlation with stocks, such as bonds or gold, the investor can reduce the risk of losses due to market fluctuations.

Alternative assets, such as real estate, collectibles, and Contemporary Art, can also provide an opportunity for portfolio diversification through inverse correlation. These assets may have an inverse relationship with traditional financial assets like stocks and bonds, and can therefore help to reduce the overall risk of a portfolio.

It’s important to note that inverse correlation is not a guarantee of protection against losses, and it’s still important to consider the inherent risks of any asset before including it in a portfolio. However, incorporating assets with an inverse relationship can be a useful tool for diversification and risk management.

The Bottom Line

Inverse correlation, or negative correlation, refers to a relationship between two variables in which one increases as the other decreases.

Understanding and identifying inverse correlation can be useful for investors looking to diversify their portfolios and mitigate risk. However, it’s important to be cautious when relying on inverse correlation and consider other factors in addition to this relationship when making investment decisions.

The information in this article is solely for educational purposes. This information should not be construed as investment advice and should not be the basis of an investment decision.