I currently have $257,000 in my bank account, what’s the best way to invest and grow it?

Billionaires and professional investors have been allocating more and more into one unexpected asset class: fine art.

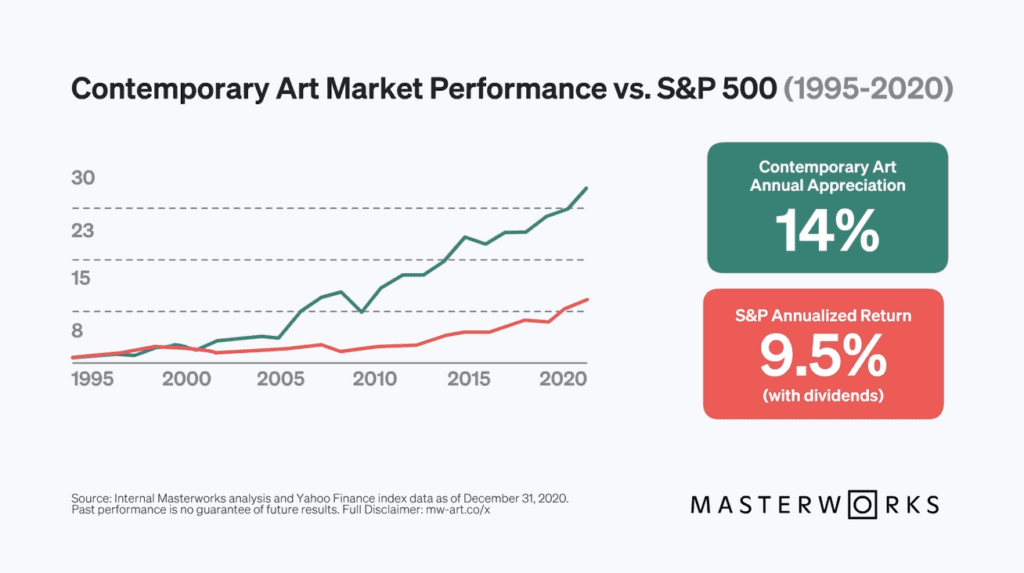

These statistics help explain why experts are so optimistic on the potential of the asset class.

- Contemporary art prices outperformed S&P 500 returns by 174% (1995-2020).

- Contemporary art historically returns 23.2% on average when inflation is at least 3%

- Art had the lowest correlation to public equities of any major asset class, according to Citi.

- $1.7 trillion asset class that is expected to grow 58% in just 5 years, according to Deloitte.

The main issue is that many of these paintings cost more than $20,000,000, making them inaccessible to everyday investors.

That’s all changed thanks to Masterworks, the first company letting anyone invest in the very same types of paintings as billionaire collectors.

Masterworks members are investing in $1M+ paintings through SEC-qualified vehicles. They’ve securitized more than $250 million in art from artists like Basquiat, Monet, and Banksy.

Plus, Masterworks was just valued at over $1 billion by venture capitalists, making them the first and only unicorn in the alternative investing space.

If you want to see what paintings are currently available to invest in, join the 225,000+ members already on Masterworks.