These are the 7 Most Common Investing Mistakes, According to Experts…

Nigel Glenday, CFO

In the past 33 years, Berkshire Hathaway’s price has risen from $7.60 to $30,000. Many would call that impossible. But Warren Buffett became one of the richest people on earth. How? By having rules and avoiding mistakes average people make. Here are the 7 most common investing mistakes, according to experts…

1— Putting all your money in a single company

In 1998, a brilliant eCommerce company was one of the first to catch onto the internet boom. After an IPO in 2000, it raised an impressive $82 million. The company received an investment from Amazon. It even hosted commercials in the Superbowl. But just 9 months later, Pet.com crashed from $14 to $0.22 cents a share.

It’s foolish to bet your money into a single company without research. One of the most successful investors in the world, Warren Buffett, has said most people should not pick single stocks.

2— Not cutting your losses

Let’s say for a moment you bought $1,000 worth of stock. Due to some unforeseen events, it drops to $500. That is a 50% loss (half the value). For you to turn that $500 into $1000 again, the stock will have to make a huge 100% return (or double the value). All said, if you cut your losses early, it gives you the chance to recoup your investment sooner. According to a popular saying accepted by experts on Wall Street “cut your losses short and let your winners run.”

3— Believing you’ll get rich fast with a penny stock

The chances of winning the lottery are 1 in 13 million, on average. There’s a better chance of getting struck by lightning (1 in 1 million). The odds of investing in penny stocks are not in your favor, either. Most of these companies have weak financials, no track records, no liquidity. Some have been pump and dump schemes set up to trick gullible investors.

According to data, the yearly returns for penny stocks are roughly minus 30%.

4— Timing the market

Data shows that more than 90% of active fund managers underperform versus the S&P SmallCap 600 benchmark over the span of 20 years. These small-cap stocks are worth anywhere from $700 million to $3.2 billion, so these aren’t just random stocks. And even though these are promising companies, most Ivy-League fund managers still lose.

Furthermore, research conducted by Schwab shows the cost of waiting for the perfect moment to invest typically cost more than the benefit of perfect timing.

5— Not knowing how to diversify

The S&P Dow Jones Indices showed that 76% of investment funds fail to beat the market over 3 years (measured in risk-adjusted returns). In fact, over the longer time span of 20 years, 94% of fund managers couldn’t beat their respective S&P indices. The overwhelming reason why? Most fund managers fail to manage risk by possibly not diversifying correctly, so an index that is correctly diversified outperforms them.

6— Listening to your emotions

Scared investors often sell at the first sign of loss. If you follow the market’s emotion, then you could miss out on this bearish trend. Oftentimes, great investors buy when others sell because the prices will be lower. Falling for emotions is the reason why many people buy at market tops and sell at market bottoms.

7— Failing to consider alternative investments

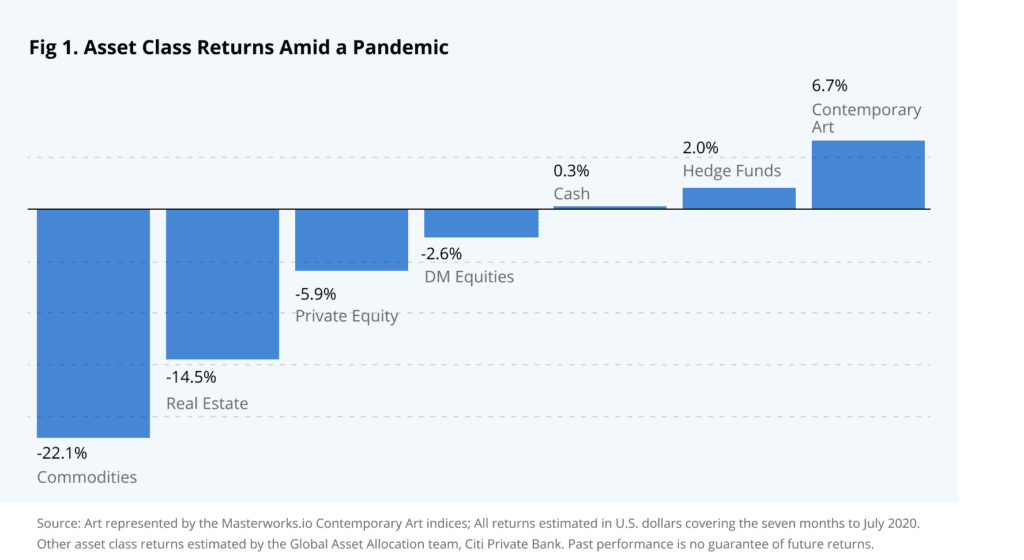

Citibank conducted a study on different assets during the first 7 months of 2020. While the pandemic raged on, assets like equities (stocks) underperformed. But alternative investments such as hedge funds and art generally fared better.

Experts at Harvard Business Review stated that “the alternative investments industry has grown in popularity and accessibility for the last decade and a half.” And if an investor is careful, an alternative asset class could be worthy to be considered.

More about alternative investments

Take for instance Contemporary Art. An alternative investment such as Contemporary Art prices outperformed the S&P 500 returns by 174% from 1995–2020.

What’s more, the global value of art and collectibles held by ultra-high-net worth individuals (UHNWI) is estimated at $1.7 trillion (currently more than every cryptocurrency combined), and projected to grow by 51% by 2026, according to a report by Citi.

And it has, on average, one of the lowest correlations to public equities of any major asset class over the last two decades.

These are some of the reasons why the world’s ultra-wealthy invest in alternative assets like Contemporary Art.

How to invest in this alternate investment?

Normally, great works of art are only accessible to the ultra-wealthy. That’s because they could cost upwards of $100,000,000. Without money and connections, these artworks are inaccessible to the average investor. That is, until now.

Masterworks is the only company dedicated exclusively to bringing the exciting and potentially lucrative art market to the masses. Everyday investors are now able to invest in some of the very same artworks collected by billionaire collectors and the top museums. These are works from artists such as Basquiat, Monet, and Banksy. Find out why over 260,000+ investors choose art as an investment.