5 of the world’s wealthiest family’s art collections that will blow your mind!

In 1855, Baron James Mayer de Rothschild wrote, “No price is too high for the acquisition of true masterpieces”. The patriarch of the French branch of the Rothschild family was not alone in this sentiment. For many of the world’s wealthiest families, building an art collection is not just a means of creating and preserving a legacy, but it also serves as an investment and overall asset diversification strategy. Let’s explore 5 of the world’s wealthiest family’s art collections:

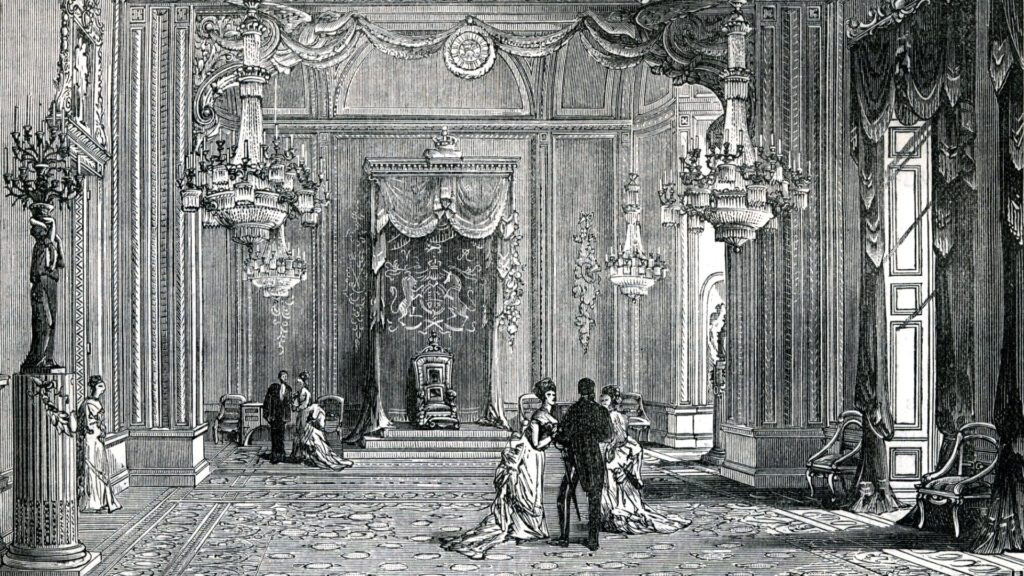

1. The Royal Family – $12.7+ Billion

Photo Credit: RockingStock

The Royal Family – one of the last great European royal collections to remain intact, the Royal Collection is a unique and valuable record of the personal tastes of kings and queens over the past 500 years, including 30,000 drawings and watercolors, and more than 7,000 paintings.

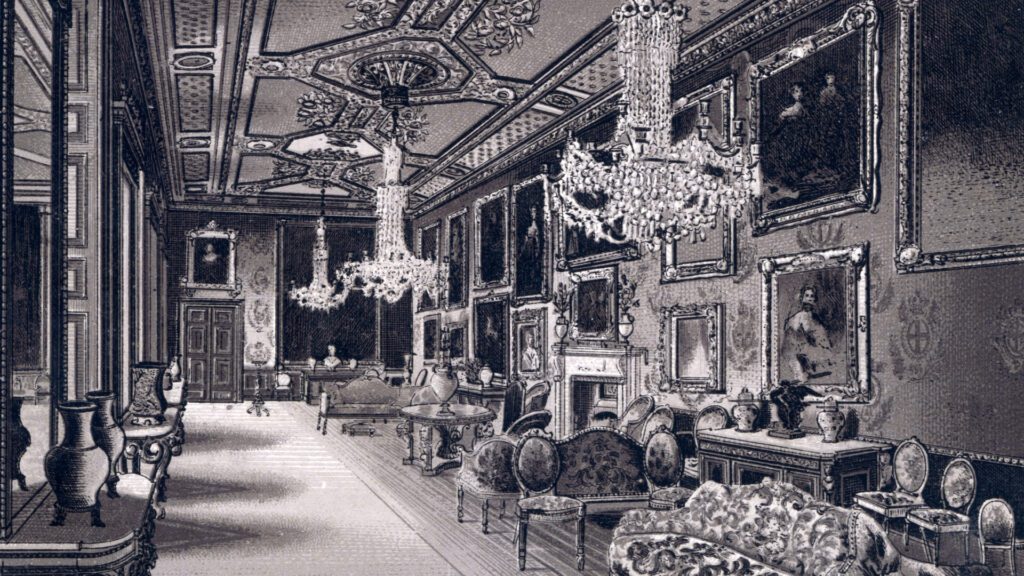

2. The Rothschilds – $2+ Billion

Photo Credit: kitera dent

The Rothschilds – for this family, collecting has been a tradition since the late 18th century. Today, many of the world’s greatest works of art have a Rothschild provenance.

3. The Rockefellers – $835.1+ Million

Photo Credit: James Kemp

The Rockefellers – the Peggy & David Rockefeller estate auction broke records totaling $835.1 million in sales in 2018, making it the most significant charitable auction in history. While a large number of works are sold and no longer in the family’s possession, their collection is still one of the most sizable by one family to date.

4. The Waltons – $500+ Million

Photo Credit: RockingStock

The Waltons – curated largely by the world’s richest woman, Walmart heiress, and philanthropist, Alice Walton, the Walton collection is estimated to be worth half a billion dollars and can be seen in part at her family-funded museum, Crystal Bridges in Arkansas.

5. The Hermés Family – Unknown

Photo Credit: drserg

The Hermés Family – while information about the art collection of this $94.6 billion family remains somewhat elusive, reports suggest that it comprises more than 10,000 items and includes several thousand books, predominantly centered around equestrian themes.

So why do these families have such large collections? Aside from the obvious beauty and cultural significance, these families know the secret about fine art that the average person does not…

Historically, fine art has served as an excellent storehold of value, allowing its collectors and investors to consistently grow their wealth at a high-rate of return. Its all-weather nature comes with a history of outperformance vs. mainstream assets, and even increasing in value when inflation is high, or the stock market is sinking.

However, up until now, there’s been a problem. These collections may seem so out of reach, either physically or because of their legendary status, as to be unattainable. But that’s all changing, thanks to the power of technology, and a group of art and finance experts working out of Manhattan’s financial district at a company called Masterworks.

Masterworks’ art investing platform is transforming and democratizing the art market, allowing anyone to collect and actually invest in masterpieces by artists like Picasso, Banksy, Basquiat, and more. They’ve already offered over 300 masterpieces ranging from six-figures to eight-figures in value. (Across Masterworks’ first 282 qualified offerings (not exited), the average offering amount was $3,003,300.) However, Masterworks members can invest in shares starting as low as $20 per share.

It’s finally possible to build a diversified portfolio of famous artworks at a fraction of the typical cost of buying whole artworks. Additionally, through October 2023, Masterworks has exited – or sold – 16 of their works. They’ve all recorded positive returns and provided over $10 million in profits to investors (net of fees).*

*[Please note: All investing activities involve risks and art is no exception. Risks associated with investing through the Masterworks platform include the following: Your ability to trade or sell your shares is uncertain. Artwork may go down in value and may be sold at a loss. Artwork is an illiquid investment. Costs and fees will reduce returns. Investing in art is subject to numerous risks, including physical damage, market risks, economic risks and fraud. Masterworks has potential conflicts of interest and its interests may not always be aligned with your interests.

Liquidation timing is uncertain. Expenses and fees are listed in our Offering Circulars. Note: Fees are 1.5% per annum (in equity), 20% profit share, and certain expenses are allocated to the investment vehicle. Investors should review the offering circular for a particular offering to learn more about fees and expenses associated with investing in offerings sponsored by Masterworks. Masterworks will receive an upfront payment, or “Expense Allocation” which is intended to be a fixed non-recurring expense allocation for (i) financing commitments, (ii) Masterworks’ sourcing the Artwork of a series, (iii) all research, data analysis, condition reports, appraisal, due diligence, travel, currency conversion and legal services to acquire the Artwork of a series and (iv) the use of the Masterworks Platform and Masterworks intellectual property. No other expenses associated with the organization of the Company, any series offering or the purchase and securitization of the Artwork will be paid, directly or indirectly, by the Company, any series or investors in any series offering. For more information, see “IMPORTANT DISCLOSURES” at Masterworks.com/cd

This post was sponsored by Masterworks.com/cd