Investing Apps: Yieldstreet

Our industry-leading research and acquisition teams use our proprietary data and art market experience to curate iconic works of blue-chip contemporary art.

Since inception in 2017, Masterworks has successfully offered and sold three paintings from its collection, each realizing a net annualized gain in excess of 30% per work.*

*This is not an indication of Masterworks’ overall performance and past performance is not indicative of future results.

FEATURED IN

Masterworks

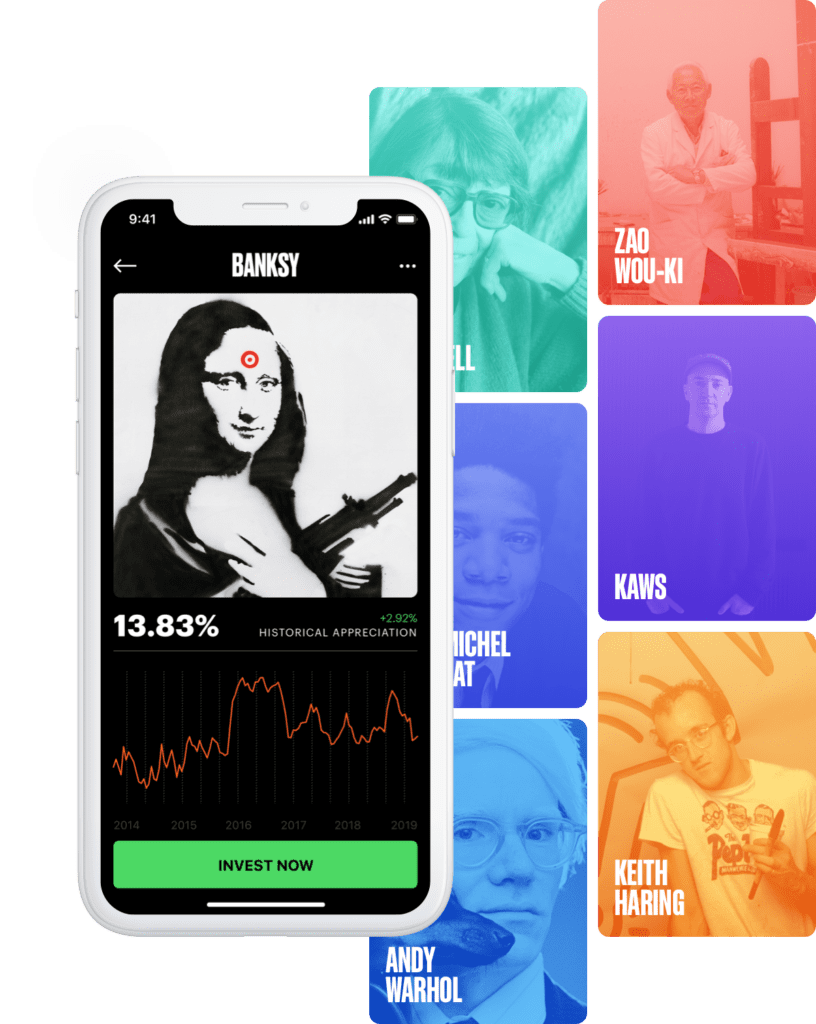

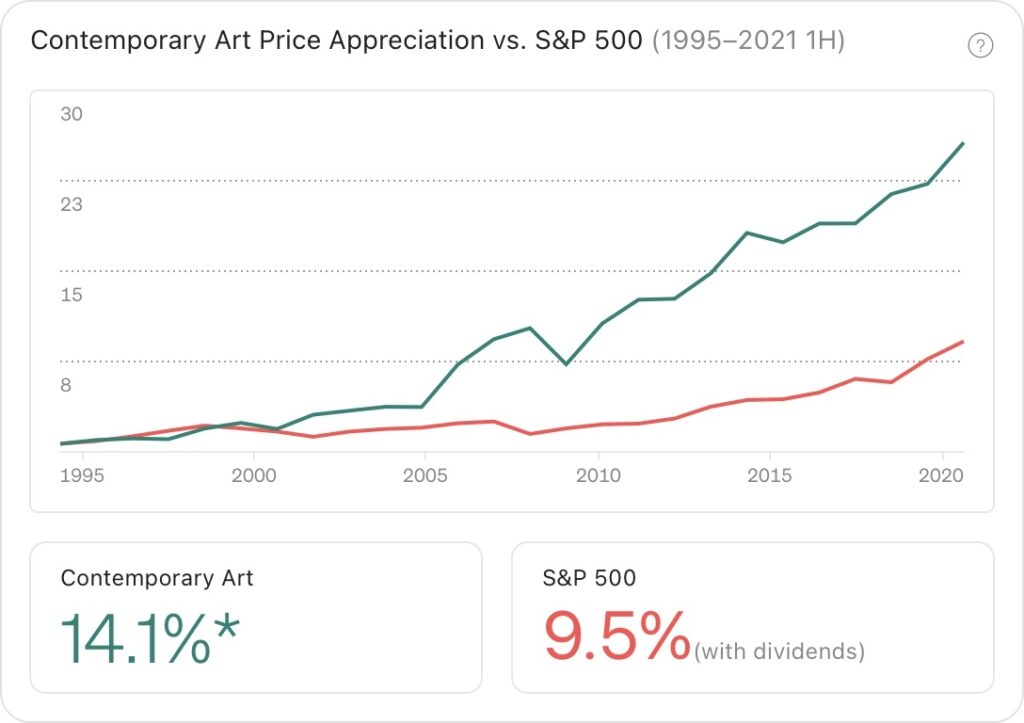

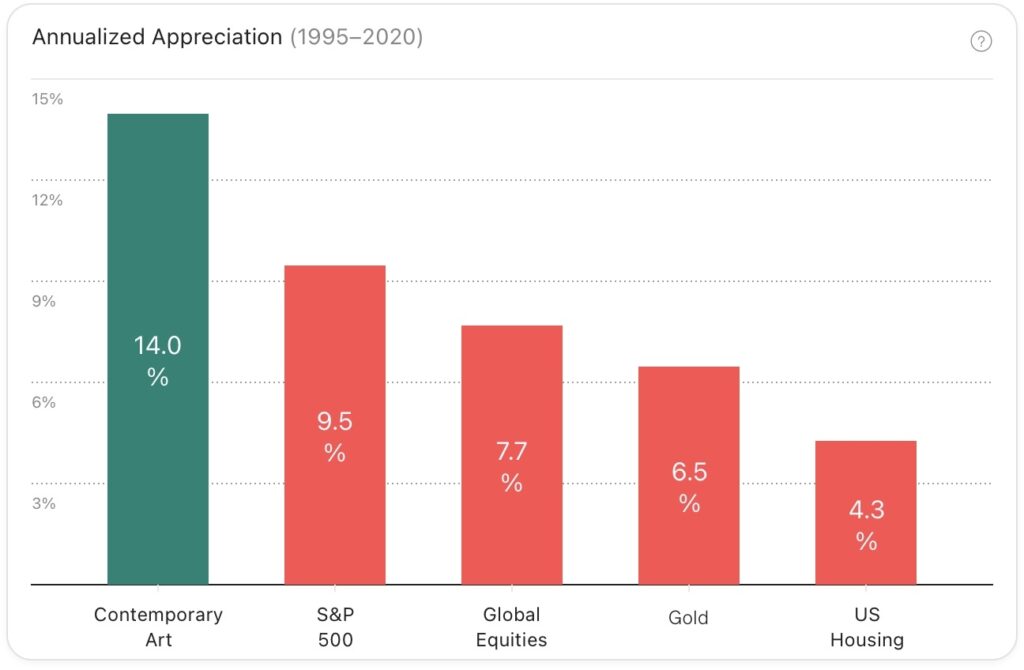

Masterworks is the first platform making it possible to invest in multimillion-dollar works from artists like Banksy, Kaws, Basquiat, and many more. Investors of all types who seek to improve their portfolio performance use our proprietary data. Contemporary art prices have appreciated by 14.1% annually on average from 1995-2021 1H.

Yieldstreet

Yieldstreet has offered two art equity funds. According to the company, the first fund is focused on post-war and contemporary art and the second fund is focused on artists inspired by the Harlem Renaissance.

Masterworks vs. Yieldstreet (Art Equity Offerings) at a glance

Yieldstreet (Art Equity Offerings) | Masterworks | |

|---|---|---|

Offerings | 2* | 100+ |

Offerings Size | $22m* | $400m+ |

Secondary market | ✓ | |

Focused exclusively on blue-chip contemporary art | ✓ | |

Ability to select individual works of art | ✓ |

*as of Mar 3, 2022

What makes Masterworks

the best Yieldstreet alternative?

$400M+

Securitized Paintings

100+

Total Offerings

15.8%

Net Annualized Track Record

Calculation Methodology

Why invest in art?

Price Appreciation

Based on Masterworks research, contemporary art prices have increased 13.6% on an annualized basis from 1995-2021 1H

Potential Inflation Hedge

During periods from 1985-2020 when inflation was equal to or higher than 3.0%, contemporary art prices had an average real price appreciation of 23.2%.

Low Correlation

Citi Private Bank calculated a correlation coefficient of 0.19 between contemporary Art and the S&P 500 from 1985-2020

Expert Data

What people are saying?

How it works

Our research team

chooses artists

We determine which artist markets have the most momentum

Masterworks purchases the painting

We acquire the best examples available, at attractive prices

The painting

is securitized

We file an offering circular with the SEC allowing anyone to invest

We hold the painting

for 3–7 years

You receive your pro rata proceeds if and when the painting sells

Join 350K+ people accessing an exclusive asset class

1

Sign up

2

Pay

3

Invest