Investing Apps: Titan

In the last 10 years, 83.1% of large-cap US Equity Funds have underperformed their benchmark*

The good news?

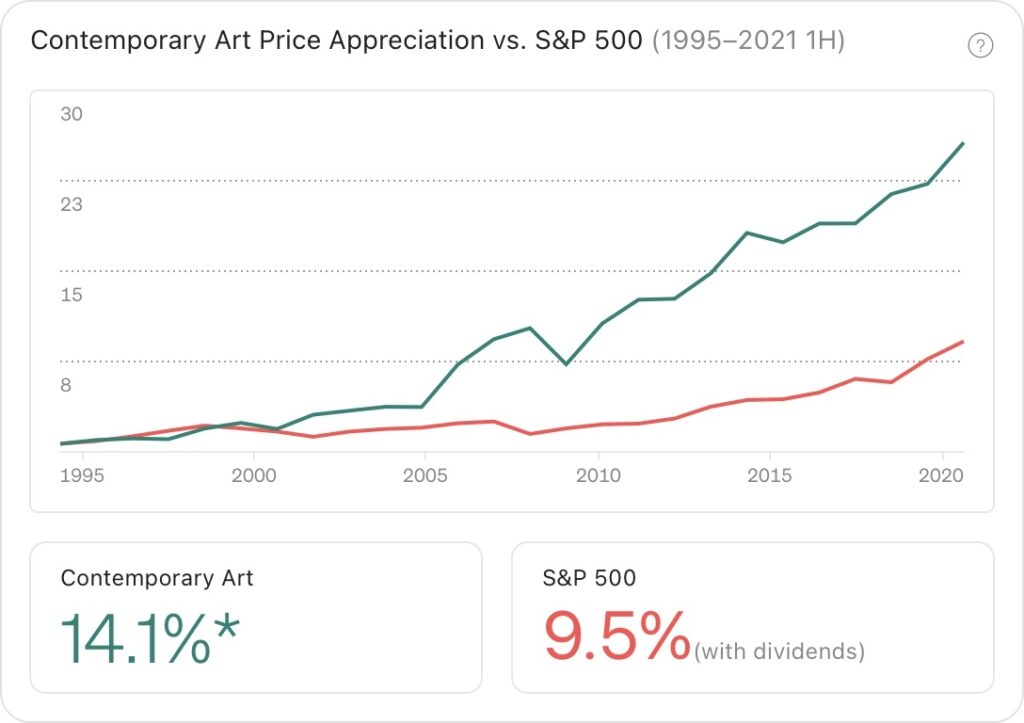

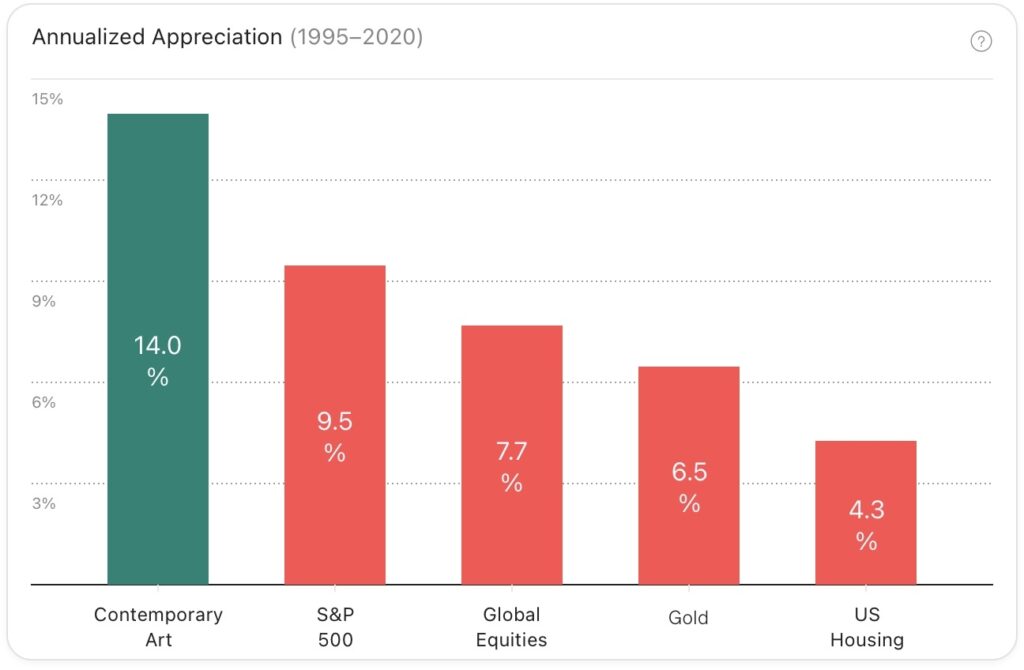

Contemporary art prices have outpaced the S&P 500 for over 25 years.

FEATURED IN

Masterworks

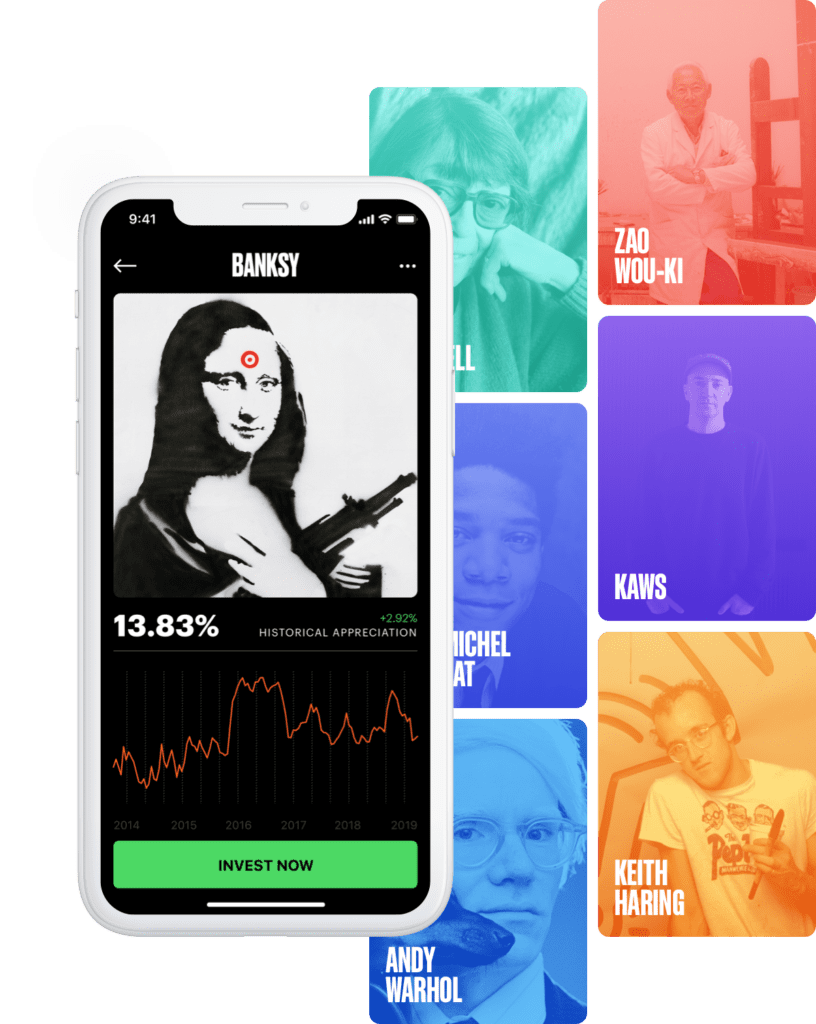

Masterworks is the first platform making it possible to invest in multimillion-dollar works from artists like Banksy, Kaws, Basquiat, and many more. Investors of all types who seek to improve their portfolio performance use our proprietary data. Contemporary art prices have appreciated by 14.1% annually on average from 1995-2021 1H.

Titan

Titan is a mobile investing platform that offers potential investors a selection of proprietary, actively-managed funds. The company has stated that it is “hedge fund-like” in that it uses investment strategies similar to these investment vehicles – but at a lower cost to investors.

Masterworks vs. Titan at a glance

Titan | Masterworks | |

|---|---|---|

Strategies | Actively managed equity and crypto portfolios. | Blue-chip contemporary art investments |

Annualized Track Record since inception | 14%* | 15.8%** |

Investments into blue-chip contemporary art | ✓ | |

Actively managed | ✓ | ✓ |

Open for international investors? | ✓ |

*Reflects performance of Titan Flagship portfolio from its inception on February 20, 2018, through February 28, 2022. **Reflects Masterworks’ historical offering-weighted performance, net of fees, from inception of its first offering on July 12, 2019 through Dec 31, 2021.

What makes Masterworks

the best Titan alternative?

$400M+

Securitized Paintings

100+

Total Offerings

15.8%

Net Annualized Track Record

Calculation Methodology

Why invest in art?

Price Appreciation

Based on Masterworks research, contemporary art prices have increased 13.6% on an annualized basis from 1995-2021 1H

Potential Inflation Hedge

During periods from 1985-2020 when inflation was equal to or higher than 3.0%, contemporary art prices had an average real price appreciation of 23.2%.

Low Correlation

Citi Private Bank calculated a correlation coefficient of 0.19 between contemporary Art and the S&P 500 from 1985-2020

Expert Data

What people are saying?

How it works

Our research team

chooses artists

We determine which artist markets have the most momentum

Masterworks purchases the painting

We acquire the best examples available, at attractive prices

The painting

is securitized

We file an offering circular with the SEC allowing anyone to invest

We hold the painting

for 3–7 years

You receive your pro rata proceeds if and when the painting sells

Join 350K+ people accessing an exclusive asset class

1

Sign up

2

Pay

3

Invest