Investing Apps: Coinbase

Diversify your portfolio with multimillion-dollar paintings. Citibank recommends allocating between 1.4%-4% of your portfolio to art.

Ready to invest in art? Join an exclusive community of investors.

FEATURED IN

Masterworks

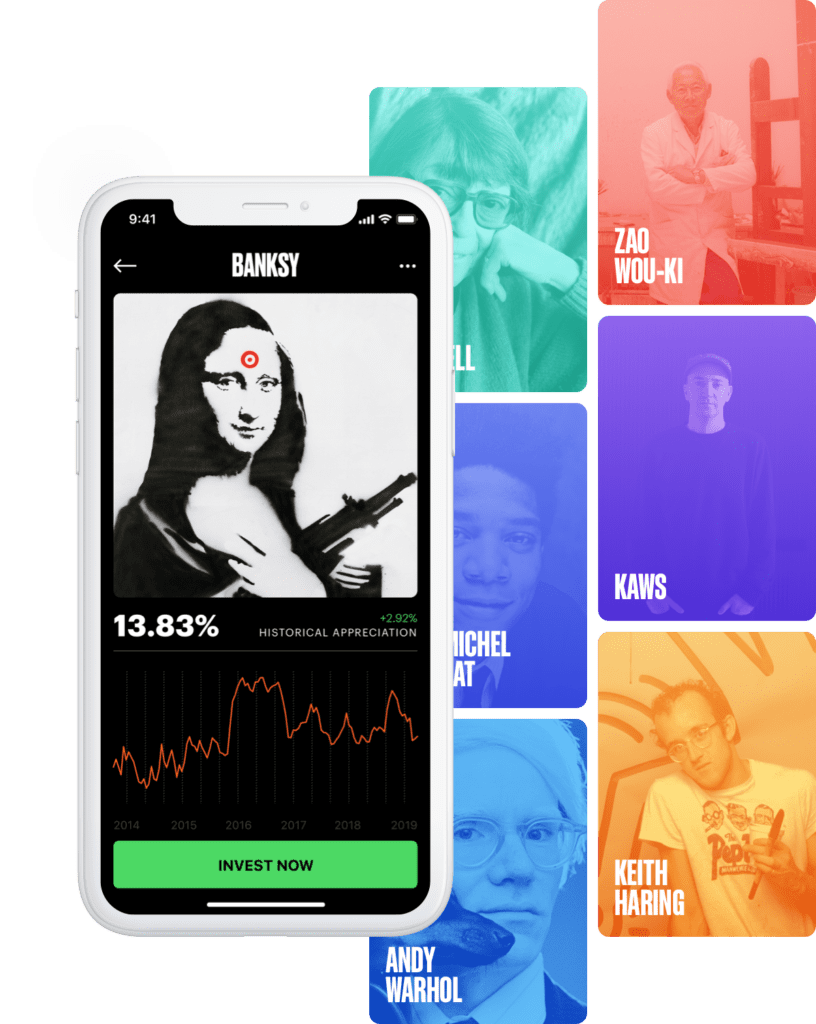

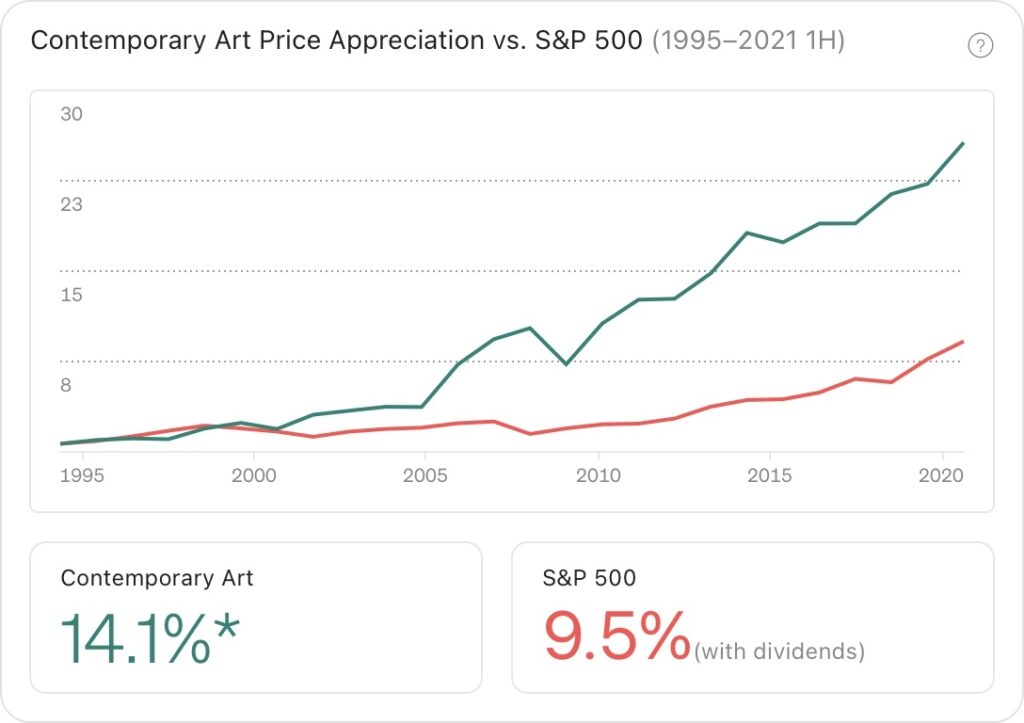

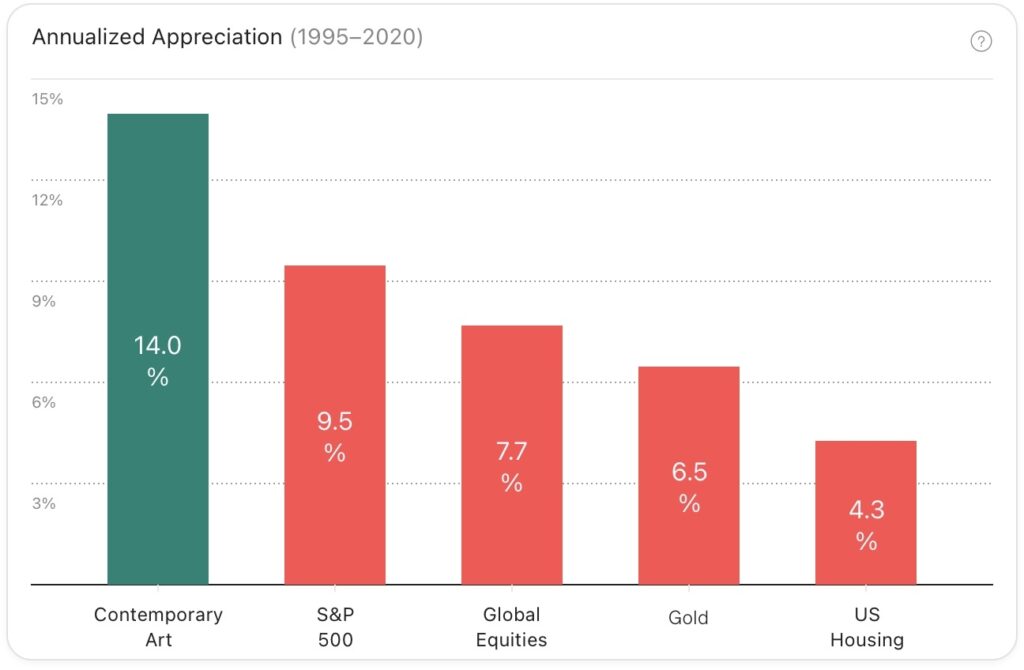

Masterworks is the first platform making it possible to invest in multimillion-dollar works from artists like Banksy, Kaws, Basquiat, and many more. Investors of all types who seek to improve their portfolio performance use our proprietary data. Contemporary art prices have appreciated by 14.1% annually on average from 1995-2021 1H.

Coinbase

Coinbase is an online platform that allows merchants, consumers, and traders to transact with digital currency. It allows its users to create their own bitcoin wallets and start buying or selling bitcoins by connecting with their bank accounts.

Masterworks vs. Coinbase at a glance

Coinbase | Masterworks | |

|---|---|---|

Buy Blue-chip Art | ✓ | |

Sell Blue-chip Art | ✓ | |

Number of offerings | 96 | 80+ |

Minimum Trade | $2 | $0 |

Trading and transaction fees | ||

Can use your own digital wallet? | Yes | Yes |

Customer Service | Just email support Emergency number for a disabled account | 24/7 dedicated investing advisor team |

Summary | Coinbase is a great place to build your crypto portfolio, but you cannot access art investing. | Masterworks is the only premium platform to invest in art, holdings are vetted by a team of art acquisition |

What makes Masterworks

the best Coinbase alternative?

$400M+

Securitized Paintings

100+

Total Offerings

15.8%

Net Annualized Track Record

Calculation Methodology

Why invest in art?

Price Appreciation

Based on Masterworks research, contemporary art prices have increased 13.6% on an annualized basis from 1995-2021 1H

Potential Inflation Hedge

During periods from 1985-2020 when inflation was equal to or higher than 3.0%, contemporary art prices had an average real price appreciation of 23.2%.

Low Correlation

Citi Private Bank calculated a correlation coefficient of 0.19 between contemporary Art and the S&P 500 from 1985-2020

Expert Data

What people are saying?

How it works

Our research team

chooses artists

We determine which artist markets have the most momentum

Masterworks purchases the painting

We acquire the best examples available, at attractive prices

The painting

is securitized

We file an offering circular with the SEC allowing anyone to invest

We hold the painting

for 3–7 years

You receive your pro rata proceeds if and when the painting sells

Join 350K+ people accessing an exclusive asset class

1

Sign up

2

Pay

3

Invest